36+ tax deduction for mortgage interest

You can deduct the interest on your mortgage on up to 1 million dollars of your home mortgage debt or up to 500000 if youre married and filing separately. Ad Get a Top-Rated HSA to take advantage of tax-free contributions growth and spending.

Mortgage Interest Tax Deduction Smartasset Com

Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of how you use the loan proceeds.

. For debts incurred before Dec. Homeowners who are married but filing separately may be allowed to deduct up to the first 350000 of their mortgage interest costs. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage debt on their primary or second home.

If you bought your home after December 15 2017 though your deduction is capped for interest on the first 750000 of mortgage debt. Single or married filing separately 12550. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every homeowner should know about the mortgage interest tax deduction.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly or 12400 for individual tax filers. Ilja Frei Unsplash 1. Ad Face-to-Face Tax Prep In-Person or Virtual.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017. Open a triple-tax advantaged HSA to enjoy tax-free saving spending and investing. Other Items You May Find Useful All Publication 936 Revisions Other Current Products Page Last Reviewed or Updated.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. The amount you can claim as your mortgage interest tax deduction is.

Web If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary homeup to 750000 if you are single or married filing. For details see IRS Publication 936. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16 2017 and 750000 for homes. Learn More At AARP. Current Revision Publication 936 PDF HTML eBook EPUB Recent Developments None at this time.

In this example you divide the loan limit 750000 by the balance of your mortgage 1500000. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan principal. Well outline the basics here.

Web When you file your tax return you must decide whether to take the standard deduction-- 12950 for single tax filers 25900 for joint filers or 19400 for heads of household or married filing. You may find the. Upload Your Tax Docs Beforehand.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Capital gains and dividends charitable contribution deduction pass-through income deduction home mortgage interest deduction. Additionally you can deduct the interest on up to 100000 of.

Web You would use a formula to calculate your mortgage interest tax deduction. Mortgages taken out before October 13 1987 also known as grandfathered debt. Web The IRS has lots of rules and guidelines to claiming the mortgage interest tax deduction.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households taxable incomes and consequently their total taxes paid. Web The entirety of the mortgage interest can be deducted if it fits into at least one of this three categories.

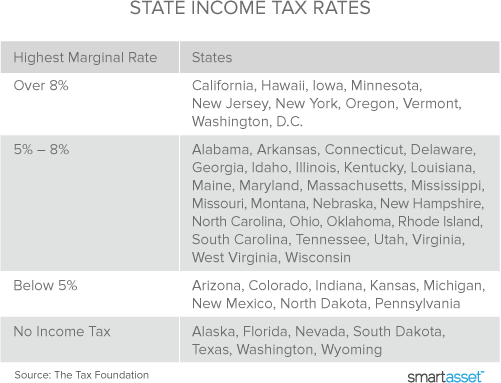

Ad Access Tax Forms. Once again the bank issues a 1098 for the mortgage interest. Web Those who filed tax returns with under 30000 in adjusted gross income AGI in 2003 received just 9 percent of deductions for home mortgage interest despite filing 52 percent of all tax returns.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. This gives you 05 which you multiply by the total interest payments you made for the year 90000. 16 2017 these numbers increase to 1 million and 500000 respectively.

For taxpayers who use married filing separate status the. That means that the mortgage interest you paid plus any other deductions. Web Publication 936 discusses the rules for deducting home mortgage interest.

1 The Tax Cuts and Jobs Act TCJA. The Tax Cuts and Jobs Act reduced the amount of principal and limited the types of loans that qualify for the deduction. There are higher limits for homeowners who got mortgages before December 16.

Married filing jointly or qualifying widow er 25100. Mortgage interest adds up faster than you might think. Home Mortgage Interest Deduction.

Complete Edit or Print Tax Forms Instantly. This is where communication is vital. Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now.

Web The problem is the bank still issues a mortgage interest statement making it look like a tax deductible item. Get Help with Tax Prep From an Experienced Tax Pro at HR Block. The median taxpayers AGI was approximately 29000 in 2003 In contrast 36 percent of home mortgage interest deductions were claimed.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web For 2021 tax returns the government has raised the standard deduction to. Taxpayers can borrow against their house to make an investment such as a cant-miss stock tip or other investment.

Web 1 day agoThe Treasury report examined eight tax expenditures. What if my situation is special. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

6551 Buckskin Trl Cheyenne Wy 82009 Mls 88516 Zillow

When Will I Get My Tax Refund Koin Com

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Haiboxing Remote Control Car 1 18 Rc Car Hailstorm 4wd All Terrain High Speed Racing Car 36 Kmh 2 4 Ghz Rc Truck 4x4 Offroad Waterproof Electric Operated Radio Controlled Toy Gift Amazon De Toys

![]()

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Bankrate

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Braun No Touch Touch Thermometer With Age Precision Positioncheck Dual Technology Safe Hygienic Fast Clinically Accurate Easy To Use For All Ages Bnt400b Amazon De Health Personal Care

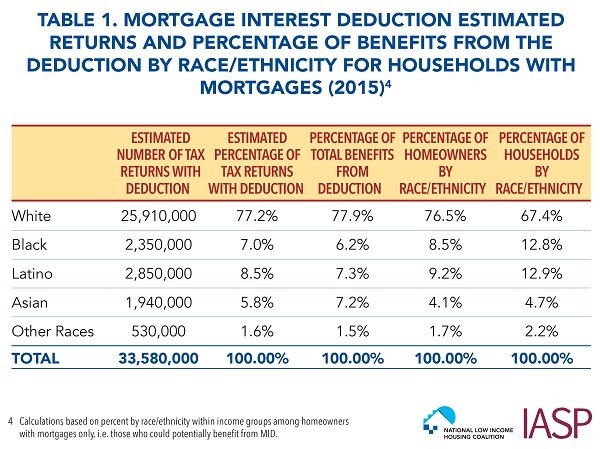

Race And Housing Series Mortgage Interest Deduction

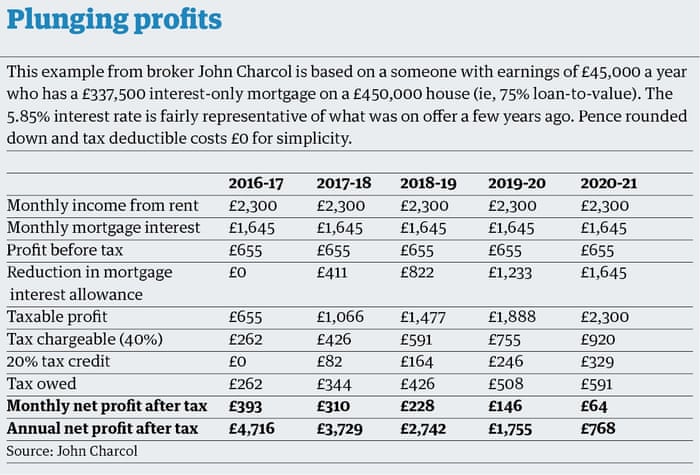

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Paying Off A Mortgage Early How To Do It And Pros Cons

Jr1os8y8bwbesm

Haiboxing Remote Control Car 4wd Rc Car 1 16 36 Km H High Speed Rc Monster Truck 2 4 Ghz Racing Car Waterproof Off Road Car Toy Gift For Children And Adults Amazon De Toys